Table of Contents

Every project begins with an idea, but not every project delivers value. Poor financial control is one of the main reasons some projects fail, even when timelines and scope look perfect on paper. Without clear planning, costs can quickly go out of control. That's when you realise that you need proper Project Financial Management.

Project Financial Management helps you plan and control project spending, instead of guessing the budget. It ensures resources are used wisely, risks are managed early, and stakeholders stay confident. In this blog, you’ll discover what is Project Financial Management, its importance and strategies to keep your projects financially healthy from start to finish. Let's get started!

What is Project Financial Management?

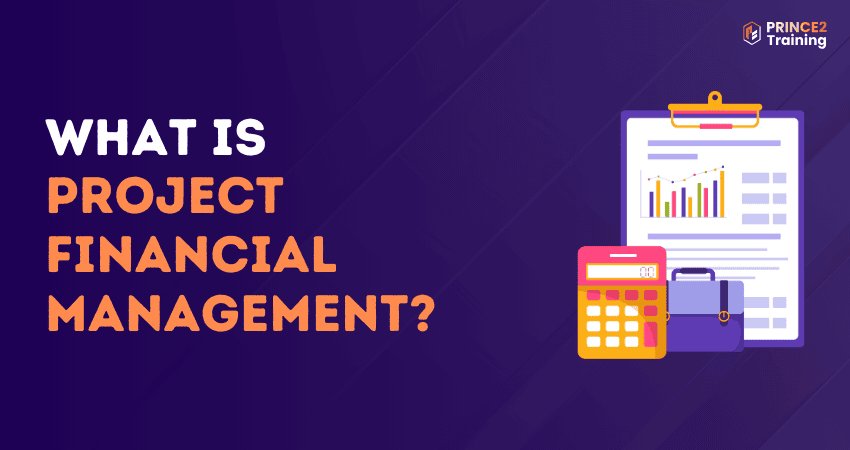

Project Financial Management refers to the planning, monitoring, controlling, and reporting of a project’s financial resources throughout its lifecycle. It ensures that project costs align with approved budgets and that financial decisions support overall project objectives.

This includes estimating costs, setting budgets, tracking expenses, predicting future costs, and analysing financial performance. It helps Project Managers understand where money is being spent and whether the project is still affordable.

Why Project Financial Management is Important?

Project Financial Management is important because it helps teams plan effectively and clearly understand how money is spent throughout a project. Regular financial monitoring helps organisations manage resources carefully and reduce the risk of unexpected costs.

It also helps teams make informed decisions that align with the project goals. This improves cost efficiency, increases transparency, and helps deliver projects within approved budgets while meeting business objectives.

How to Create a Project Financial Management?

Now that you know how important Project Financial Management is, here is how you can create one for your business or organisation:

1) Develop Your Project Cost Estimates

Cost estimation is the first step in managing project finances. It involves identifying all expected costs, such as labour, materials, tools, travel, and contingency funds.

You can make accurate estimates based on previous project data, expert input, and realistic assumptions. When estimates are too optimistic or incomplete, projects are more likely to exceed their budgets later.

2) Define the Project Budget

After estimating costs, the next step is to create a project budget. This budget sets the financial limits for the project and acts as a reference point for all spending.

A good project budget includes costs for each phase of the project, allowances for risks, and clear approval rules. It needs to be reviewed and approved by key stakeholders before the project begins.

3) Select Team Members for the Project

The team members involved in a project play a major role in financial performance. Choosing skilled and experienced team members helps reduce errors, delays, and further rework.

Labour costs are often one of the largest project expenses. Understanding team availability, skills, and costs helps manage spending more effectively. Also, assigning proper roles and responsibilities reduces duplication of work, saves time and costs.

4) Define a Simple Process to Monitor Project Costs

Keeping track of how much you are spending on a project is not a one-time process. Instead, cost monitoring is an ongoing activity that has to be carried out throughout the project.

Regular cost reviews, variance analysis, and forecasting help maintain cost control. Project Managers have to decide how often financial data will be reviewed and which tools will be used for tracking. Using financial dashboards can simplify reporting and provide real-time insights.

Improve project outcomes with better cost control with our PRINCE2® Practitioner Training – Register today!

Benefits of Project Financial Management

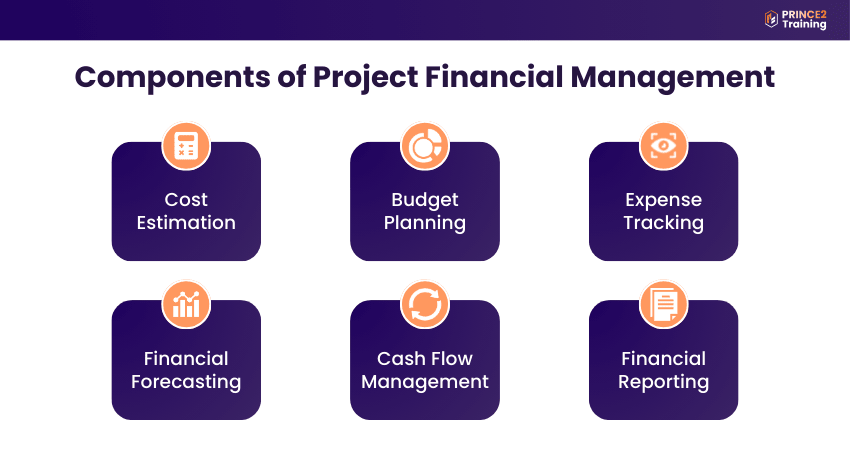

When implemented correctly, Project Financial Management delivers a wide range of benefits that extend beyond cost control. Here are those benefits:

1) Providing Key Metrics and a Roadmap

1) Shows clear information about project costs and spending

2) Helps track progress using simple financial figures

3) Acts as a roadmap for planning and managing the project

4) Helps spot budget problems early

5) Keeps everyone aligned on financial goals

2) Minimises Cost Overruns

1) Maintains spending within the planned budget

2) Identifies extra costs at an early stage

3) Allows quick action to control expenses

4) Reduces waste and unnecessary spending

5) Helps projects stay within approved limits

3) Prioritisation of Projects

1) Helps compare projects based on cost and value

2) Supports better decisions on where to spend money

3) Ensures important projects get priority

4) Aligns projects with business needs

5) Supports long-term strategic planning

4) Improve Client Relationships

1) Builds trust through clear cost updates

2) Keeps clients informed about project spending

3) Reduces confusion about budgets and payments

4) Shows responsible Financial Management

5) Strengthens long-term client relationships

5) Prevents End-of-project Surprises

1) Monitors costs regularly instead of at project closure

2) Identifies budget issues early

3) Avoids unexpected costs at the end

4) Improves the accuracy of final budgets

5) Increases confidence in project outcomes

6) Make Informed Decisions

1) Provides real-time financial data for decision-making

2) Supports objective review of scope changes

3) Helps assess financial impact before approvals

4) Reduces dependency on assumptions or guesswork

5) Improves overall project outcomes

7) Supports Business Growth

1) Ensures project spending creates real value

2) Improves returns from project investments

3) Supports business planning and future growth

4) Strengthens long-term financial stability

5) Helps organisations grow through smarter spending

Combine Agile flexibility with PRINCE2 control with PRINCE2 Agile® Foundation Training – Sign up soon!

Challenges in Project Financial Management

Despite its importance, managing project finances is not without challenges. Understanding these issues helps organisations prepare and respond effectively. Common challenges include the following:

1) Unplanned or Unexpected Costs

1) Occur due to sudden changes or problems

2) Put extra pressure on the project budget

3) Becomes hard to predict during planning

4) Can affect timelines and project delivery

2) Inaccurate Budget Forecasting

1) Happens when cost estimates are not realistic

2) Creates budgets that do not match real needs

3) Leads to frequent budget changes

4) Increases the chance of overspending

3) Cash Flow Management

1) Delayed funds can slow project progress

2) Uneven spending causes money issues

3) Affects timely payments to teams and vendors

4) Needs close work with finance teams

4) Scope Creep

1) Happens when extra work is added without approval

2) Increases costs without updating the budget

3) Puts pressure on resources and schedules

4) Reduces control over project finances

5) Communication Gaps

1) Financial updates are not shared properly

2) Causes confusion about project budgets

3) Slows down decision-making

4) Reduces transparency and trust among teams and stakeholders

Strategies to Effectively Manage Project Financials

Financial Project Management is not just about creating a budget at the beginning. As projects move forward, costs can change and increase if they are not managed properly. Using the right financial strategies helps control spending, reduce risks, and ensure the project stays on budget while delivering value. Those strategies are mentioned below:

1) Clearly Define the Project Scope

Clearly defining your project scope helps control costs from the start. When everyone knows what is included in the project, it becomes easier to plan the budget and avoid extra work. This can later reduce confusion and prevent unnecessary spending.

Key Tips:

1) Write down project goals and deliverables

2) Get approval from all key stakeholders

3) Avoid starting work without clear requirements

4) Use a formal process for scope changes

5) Share scope details with the team

2) Conduct a Feasibility Assessment

A feasibility assessment in a Project Financial Management checks if a project is practical and affordable before it starts. It helps understand how much it will cost, the benefits that can be gained, and predict the possible risks early. This ensures money is not wasted on projects that may fail.

Key Tips:

1) Review estimated costs and expected benefits

2) Check resource and skill availability

3) Identify possible financial risks

4) Compare different project options

5) Involve stakeholders in the decision-making process

3) Identify and Reduce Project Risks

Finding financial risks of a project in the early stages helps avoid budget problems that might occur in the future once the project is halfway through. Risks like delays or supplier issues can increase costs if not managed properly. Planning ahead reduces their impact on the budget.

Key Tips:

1) List risks during project planning

2) Assign responsibility for each risk

3) Prepare backup plans for possible actions

4) Review your project risks regularly

5) Adjust budgets when needed

Enrich your project planning and control skills with PRINCE2® Foundation Training – Join immediately!

4) Perform a Cost-Benefit Analysis

Cost-Benefit analysis compares how much a project costs with the value it brings. It helps decide if a project or change is worth the money. This allows teams to choose options that provide the best value with the least financial risk.

Key Tips:

1) List all project costs including direct and indirect costs

2) Identify both tangible and intangible benefits

3) Compare costs with the benefits you can get

4) Use analysis before approvals

5) Review results with decision-makers

5) Create a Detailed Project Budget

A detailed project budget shows where money will be spent. It helps track costs easily and keeps spending under control during the project. It also improves visibility into expenses and supports better financial planning.

Key Tips:

1) Break the budget into clear categories

2) Include extra funds for future risks

3) Match the budget with the project timeline

4) Review the budget with stakeholders

5) Track spending against the budget

6) Secure Adequate Funding

Projects should always start only when their funding is confirmed. Proper funding avoids delays and financial stress during execution. This simple step ensures that resources and payments are available when needed.

Key Tips:

1) Get your budget approval before starting

2) Plan funds based on project stages

3) Manage cash flow carefully

4) Communicate funding needs early

5) Monitor available funds regularly

7) Develop a Comprehensive Resource Plan

Resource planning links people, materials, and equipment to the project budget. A strong resource plan helps control labour costs, avoid shortages, and improve productivity across the project lifecycle.

Key Tips:

1) Identify required skills and resources

2) Plan resource usage over time

3) Avoid overloading of team members

4) Track resource-related costs

5) Adjust plans when availability changes

8) Determine the Project Break-even Point

The break-even point shows when project costs are recovered through benefits or revenue. Understanding this point helps organisations assess financial risk and decide whether the project is sustainable in the long term.

Key Tips:

1) Calculate total project costs

2) Estimate expected financial returns

3) Identify when costs equal benefits

4) Use this data for project decisions

5) Review calculations regularly

9) Calculate Return on Investment (ROI)

ROI measures the value a project delivers compared to its cost. It helps organisations evaluate success, compare projects, and justify future investments based on financial performance. It supports better decision-making by showing which projects deliver the highest returns.

Key Tips:

1) Calculate total project costs

2) Measure financial and business benefits

3) Use a simple ROI formula

4) Compare ROI across projects

5) Use results for future planning

Conclusion

Project Financial Management plays a key role in the success of any project. It helps organisations plan budgets clearly, track spending, and control costs at every stage of the project. With proper Financial Management, businesses can avoid overspending, reduce risks, and make confident decisions based on accurate data.

Learn how to plan, control, and deliver projects through PRINCE2® Certification – Explore now!

Back

Back

Back to

topics

Back to

topics